You’re welcome to think that - realistically the two things have nothing to do with each other.It's not legal to turn a profit and then claim nonexistent losses, which is how the vast majority of wealthy individuals and corporations operate in the modern day. They're never worried about the legality of it to begin with, however, as they know they'll never be audited.

Even pretending for a moment that the losses claimed are legitimate, the whole thing reeks of failing one's way to the top, which is not indicative of a healthy economic model. Completely unsurprising then that we're subjected to a massive crash at least once a decade now, as billionaires are the proverbial bulls in a china shop.

-

Friendly reminder: The politics section is a place where a lot of differing opinions are raised. You may not like what you read here but it is someone's opinion. As long as the debate is respectful you are free to debate freely. Also, the views and opinions expressed by forum members may not necessarily reflect those of GBAtemp. Messages that the staff consider offensive or inflammatory may be removed in line with existing forum terms and conditions.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump tax returns released, and no one is surprised that he was doing tax avoidence

- Thread starter Deleted member 586536

- Start date

- Views 10,150

- Replies 184

- Likes 7

If you believe the IRS is failing to prosecute people for tax evasion, what is the purpose of the 87,000 additional agents?It's not legal to turn a profit and then claim nonexistent losses, which is how the vast majority of wealthy individuals and corporations operate in the modern day. They're never worried about the legality of it to begin with, however, as they know they'll never be audited.

Since I day trade, I can speak on this from first hand experience. All of my winning trades add to my yearly income. All of my losing trades subtract from my income. What it seems that you want is for people to only be able to claim their profits and to ignore their losses completely. So my first year of day trading, I had more losses than winners. Say I lost $10,000. Let's say my salary at that time was $90,000. My tax preparer subtracted my losses from my salary, along with other deductions like the child tax credit, interest on my student loans, head of household, and my total income was less than $80,000. Is there something wrong with doing this? Did I break the law? Of course I didn't.Even pretending for a moment that the losses claimed are legitimate, the whole thing reeks of failing one's way to the top, which is not indicative of a healthy economic model. Completely unsurprising then that we're subjected to a massive crash at least once a decade now, as billionaires are the proverbial bulls in a china shop.

I also don't agree with using the tax code as a weapon, but from what I'm seeing from certain corporations today, I'm coming around to it.

You're not allowed to be shocked that the guy who sold $100 digital trading cards is a lying grifter. I know your ego is all wrapped up in Trumpism, but it's better to rip that band-aid off now. Politicians and celebrities are not meant to be worshiped, let alone politicians that are too inept to govern and D-list reality TV celebrities.

you keeping using that word but i dont think it means what you think it means.

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

Nonsense. They keep wages stagnant as they cause runaway inflation by hoarding wealth in offshore bank accounts, and simultaneously jack up prices for no reason other than profiteering. Then tax season comes along and they give none of it back, ensuring we never have the funds to improve infrastructure, healthcare, education, or anything else connected to the average person's quality of life. Rob us blind both coming and going.You’re welcome to think that - realistically the two things have nothing to do with each other.

I should be a little more patient where that's concerned, as it will take time for those additional hires and resources to have a notable effect on the agency's ability to go after the big fish. It's just sickening that they've been getting away with it for four plus decades already, so I'm a bit pessimistic about how much improvement we're really gonna see.If you believe the IRS is failing to prosecute people for tax evasion, what is the purpose of the 87,000 additional agents?

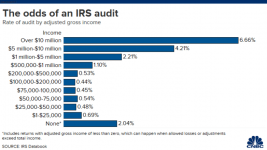

It comes back to the two-tiered system I mentioned before. The poorer you are, the more stingy they'll be about allowing you to claim write-offs and losses, and it's all the more likely you'll be audited. Even in the tens of thousands you're gonna be under a lot more scrutiny than a billionaire claiming losses in the tens of millions.Since I day trade, I can speak on this from first hand experience. All of my winning trades add to my yearly income. All of my losing trades subtract from my income. What it seems that you want is for people to only be able to claim their profits and to ignore their losses completely. So my first year of day trading, I had more losses than winners. Say I lost $10,000. Let's say my salary at that time was $90,000. My tax preparer subtracted my losses from my salary, along with other deductions like the child tax credit, interest on my student loans, head of household, and my total income was less than $80,000. Is there something wrong with doing this? Did I break the law? Of course I didn't.

The only entity that can cause inflation is the Federal Reserve working in cahoots with the government. Companies do not set monetary policy. I really wish the left would learn this.Nonsense. They keep wages stagnant as they cause runaway inflation by hoarding wealth in offshore bank accounts, and simultaneously jack up prices for no reason other than profiteering. Then tax season comes along and they give none of it back, ensuring we never have the funds to improve infrastructure, healthcare, education, or anything else connected to the average person's quality of life. Rob us blind both coming and going.

The 87,000 will just be enforcing the same laws the current IRS agents enforce. So if you are looking for any kind of early morning busts with CNN cameras at the ready, you are gonna be waiting a long time. It's not the number of agents, it's the actual laws the uniparty have been passing for decades.I should be a little more patient where that's concerned, as it will take time for those additional hires and resources to have a notable effect on the agency's ability to go after the big fish. It's just sickening that they've been getting away with it for four plus decades already, so I'm a bit pessimistic about how much improvement we're really gonna see.

Honest question. Why aren't you mad at Congress for passing laws with loopholes for their donors?

Poor people do not make the same kind of income as rich people do. And I'm certain that a higher percentage of billionaires are audited than the bottom 90% of income earners.It comes back to the two-tiered system I mentioned before. The poorer you are, the more stingy they'll be about allowing you to claim write-offs and losses, and it's all the more likely you'll be audited. Even in the tens of thousands you're gonna be under a lot more scrutiny than a billionaire claiming losses in the tens of millions.

Of course, an easy fix would be to just eliminate taxes for anybody making less than $250,000. That way poor people would be paying $0 in taxes, which they pretty much do now. It would save taxpayers millions per year in paperwork. I floated this idea on another thread and leftists were totally against cutting taxes for low income earners. Maybe we could agree on that though. We do seem to be on a roll lately.

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

The Fed constantly has to print new money because the vast majority of what's already been printed ends up stashed in hiding places around the globe by billionaires. Less hoarding of wealth that can't even be spent in a thousand lifetimes = less inflation.The only entity that can cause inflation is the Federal Reserve working in cahoots with the government. Companies do not set monetary policy. I really wish the left would learn this.

It's both the number of agents and the IRS' funding that are major factors here. It can take years to audit a rich person with hundreds of sources of income, but ultimately each dollar spent auditing them yields an exponentially greater return than auditing anyone making less than 100K would.The 87,000 will just be enforcing the same laws the current IRS agents enforce. So if you are looking for any kind of early morning busts with CNN cameras at the ready, you are gonna be waiting a long time. It's not the number of agents, it's the actual laws the uniparty have been passing for decades.

I am, but I'm more angry at their billionaire donors who lobbied for the loopholes in the first place. Also at the Republican-majority Supreme Court which brought us Citizens United and ensured that unregulated capitalism would be able to overrule our democracy and our government.Honest question. Why aren't you mad at Congress for passing laws with loopholes for their donors?

Sounds good to me. Naturally we'd have to raise both the minimum rate on all tax brackets above $250,000 to compensate, but anyone making that much is already living an extremely comfortable life as-is.Of course, an easy fix would be to just eliminate taxes for anybody making less than $250,000. That way poor people would be paying $0 in taxes, which they pretty much do now. It would save taxpayers millions per year in paperwork. I floated this idea on another thread and leftists were totally against cutting taxes for low income earners. Maybe we could agree on that though. We do seem to be on a roll lately.

That is not why the Federal Reserve prints money. They print money because the government keeps borrowing trillions of dollars every year. We have too many dollars chasing too few goods. The federal reserve banking system we've been living under since 1913 is failing, which is a reason why other countries are not buying oil in dollars anymore. We are about to lose our reserve currency status of the world.The Fed constantly has to print new money because the vast majority of what's already been printed ends up stashed in hiding places around the globe by billionaires. Less hoarding of wealth that can't even be spent in a thousand lifetimes = less inflation.

The IRS is not going to spend hundreds of thousands or millions of dollars auditing one billionaire over the course of years when all they need to do is send letters to a million middle class taxpayers who will just pay without a legal challenge.It's both the number of agents and the IRS' funding that are major factors here. It can take years to audit a rich person with hundreds of sources of income, but ultimately each dollar spent auditing them yields an exponentially greater return than auditing anyone making less than 100K would.

You are more angry at the fat kid who keeps asking for free ice cream and not the parent who keeps giving it to him making him fatter. That doesn't make sense. Let's hold the people who actually hands the free ice cream out responsible. And I agree, Citizens United needs to be looked at again. If Roe v Wade can be overturned, precedent has been set to overturn other Supreme Court decisions and Citizens United would be a good start. And I used to support that decision, but not after what I've seen corporations do over the past 6 years.I am, but I'm more angry at their billionaire donors who lobbied for the loopholes in the first place. Also at the Republican-majority Supreme Court which brought us Citizens United and ensured that unregulated capitalism would be able to overrule our democracy and our government.

Making $250,000 in Los Angeles or NYC is barely making ends meet. Here in south Florida, it's becoming a challenge making it on a six figure salary.Sounds good to me. Naturally we'd have to raise both the minimum rate on all tax brackets above $250,000 to compensate, but anyone making that much is already living an extremely comfortable life as-is.

I really am glad that we have found a lot of common ground even though I know we disagree on a lot. It's ok to disagree. It would be a boring world if everybody thought the same way as me. I hope others are reading our conversation and taking note.

That’s not why the fed “prints money” - somebody doesn’t know how quantitive easing works. Inflation is, by and large, created in Washington.The Fed constantly has to print new money because the vast majority of what's already been printed ends up stashed in hiding places around the globe by billionaires. Less hoarding of wealth that can't even be spent in a thousand lifetimes = less inflation.

Edit: As for cutting taxes, the bottom 50% of earners contribute 3% of total income tax revenue. The top 1% of earners cover 39%, which is more than the bottom 90% (29% of the total). If half of the country stopped paying the income tax altogether, the federal government wouldn’t even notice the dent. There is absolutely no legitimate reason to perpetuate the income tax in its current form, it was supposed to fund the war effort when it was introduced and we’re not in the middle of a world war anymore. It’s fleecing the poor for next to no benefit on the final tally - the people could spend that money better, improving their quality of life tremendously.

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

Quantitative easing only started becoming more common after the 2008 crash, and we both know which individuals and entities were responsible for that. Such measures wouldn't be necessary at all if the working class had more purchasing power to begin with, and if billionaires didn't have such a constantly detrimental effect on the economy's health.That’s not why the fed “prints money” - somebody doesn’t know how quantitive easing works. Inflation is, by and large, created in Washington.

It's tens of thousands to recover tens of millions, or tens of thousands to recover thousands from average Joes. Wealthy individuals are also far more likely to try to illegally evade taxes in the first place, as it's nigh impossible to hide anything behind an income of roughly ~50K from a single source.The IRS is not going to spend hundreds of thousands or millions of dollars auditing one billionaire over the course of years when all they need to do is send letters to a million middle class taxpayers who will just pay without a legal challenge.

With a two-party system, it was inevitable that we'd eventually elect a shitheel president like Reagan who would be responsible for out of control deregulation. Billionaires should not exist at all, but they do, and they're fully aware that what they're doing is wrong. They're not children, and the consequences for their actions must reflect that.You are more angry at the fat kid who keeps asking for free ice cream and not the parent who keeps giving it to him making him fatter.

I don't even object to the idea of tuning the federal tax rate on a cost of living scale, state by state. At some point though, it needs to jump to between 70% and 90%, a million plus in annual income for that sounds about right.Making $250,000 in Los Angeles or NYC is barely making ends meet. Here in south Florida, it's becoming a challenge making it on a six figure salary.

Isn't the U.S. always at war with someone. Plenty of wars to fund our efforts for world domination.There is absolutely no legitimate reason to perpetuate the income tax in its current form, it was supposed to fund the war effort when it was introduced and we’re not in the middle of a world war anymore.

I bet we have a different opinion on what caused it and who was responsible. Lemme think, who forced banks to approve loans for people who couldn’t possibly pay them off… and who told those banks that if things go sideways, they’ll just get bailed out anyway…Quantitative easing only started becoming more common after the 2008 crash, and we both know which individuals and entities were responsible for that. Such measures wouldn't be necessary at all if the working class had more purchasing power to begin with, and if billionaires didn't have such a constantly detrimental effect on the economy's health.

We’ll never know. Definitely wasn’t the government though.

For the record, I blame both Republicans *and* Democrats since both parties are hellbent on improving the housing issue by any means necessary, with complete disregard for the consequences. If I were in charge of a bank and the government told me that I can give loans to just about anyone and if they end up unable to pay later down the line they’ll foot the bill, I’d be giving out loans like Halloween candy since it’s a risk-free operation - I’m making money no matter what. Just my 2 cents.

Not a world war or a war on home turf, although the Ukraine faucet seems to be permanently open for the time being. Novel thought - maybe the government just has too much money, and too much control over money supply. Thanks Woodrow Wilson, thanks FDR.Isn't the U.S. always at war with someone. Plenty of wars to fund our efforts for world domination.

Please explain the out of control inflation during the 70's. There were a lot less billionaires back then than what we have now.Quantitative easing only started becoming more common after the 2008 crash, and we both know which individuals and entities were responsible for that. Such measures wouldn't be necessary at all if the working class had more purchasing power to begin with, and if billionaires didn't have such a constantly detrimental effect on the economy's health.

The government is not going to go after their own donors. Full stop.It's tens of thousands to recover tens of millions, or tens of thousands to recover thousands from average Joes. Wealthy individuals are also far more likely to try to illegally evade taxes in the first place, as it's nigh impossible to hide anything behind an income of roughly ~50K from a single source.

The Democrats controlled the House during both of Reagan's terms and controlled the Senate for the final two years. Are you understanding the uniparty problem that we have had for decades now?With a two-party system, it was inevitable that we'd eventually elect a shitheel president like Reagan who would be responsible for out of control deregulation. Billionaires should not exist at all, but they do, and they're fully aware that what they're doing is wrong. They're not children, and the consequences for their actions must reflect that.

Why does that sound about right? Because you think so? That is just using the tax code as a weapon out of jealousy, not real policy. If we continue to have a tax code, the rich will always bend it to their will and prevent the rest of us from reaching those same goals. It's why large corporations push for regulations, because they can afford it while their smaller competitors can not. Rich people and corporations will always have the means to lobby Congress to write laws that favor them.I don't even object to the idea of tuning the federal tax rate on a cost of living scale, state by state. At some point though, it needs to jump to between 70% and 90%, a million plus in annual income for that sounds about right.

We did not have an income tax or a central bank until 1913, and we also didn't have billionaires before their creation. We barely even had any millionaires. Is there a correlation? Who knows?

Post automatically merged:

We are currently not in a war right now, surprisingly. But they sure are trying to start one with a nuclear power and nobody sees a problem with this.Isn't the U.S. always at war with someone. Plenty of wars to fund our efforts for world domination.

There are two tax brackets that the IRS is most interested in - up to $25K and over $500K. The first group is easier and faster to audit, doesn’t have the resources to fight the government *and* can be easily trapped in the web of various welfare program requirements. This is supported by GAO analysis - the IRS aims at easy targets.The government is not going to go after their own donors. Full stop.

https://www.gao.gov/products/gao-22-104960

Here’s another graph to better visualise this, since the GAO one is ass.

You have higher odds (double) of being audited if you have zero income than you do if you make $500K-$1M. Cases of more than $10M income within one tax year are relatively few and far between - around 23.5K households in the U.S., and they’re well-off enough to offload the duty of filing taxes to an army of pencil pushers, so they don’t care.

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

The same people that brought us the invasion of Afghanistan and Iraq 2: Electric Boogaloo without any exit strategy. At the behest of their billionaire and corporate donors, of course. They were even warned in the early 2000s that deregulation was causing instability in the housing market, and kept pushing ahead with more of it anyway. Probably in the hopes that a Dem would be elected president before the shit ultimately hit the fan.I bet we have a different opinion on what caused it and who was responsible. Lemme think, who forced banks to approve loans for people who couldn’t possibly pay them off… and who told those banks that if things go sideways, they’ll just get bailed out anyway…

Nixon's economic policies were garbage, that pretty much sums it up.Please explain the out of control inflation during the 70's. There were a lot less billionaires back then than what we have now.

For Democrats, going after billionaires and megacorps is good optics. That's not a guarantee it will happen, but those were the instructions Biden gave to the IRS along with the additional funding and resources. Additionally, not every billionaire and corporation donates to political parties. We'll just have to wait and see. As I said before, I'm tepidly optimistic at best.The government is not going to go after their own donors. Full stop.

In other words, Reagan got everything he wanted for six years. Thus the era of "greed is good" began, as did the decline of the American middle class.The Democrats controlled the House during both of Reagan's terms and controlled the Senate for the final two years. Are you understanding the uniparty problem that we have had for decades now?

No, it's governance for the many instead of the few. Again: the top tax bracket was 90% when the middle class was at its most prosperous in this country. It wasn't coincidence, and in the modern day we can't keep making the same mistakes over and over expecting different results.Why does that sound about right? Because you think so? That is just using the tax code as a weapon out of jealousy, not real policy.

You proposed we eliminate taxation for those making less than $250,000, it's only common sense then that anybody making more would need to have their taxes raised to compensate for that. You might be swayed by crocodile tears coming from people looking to buy a large yacht to tow their smaller yacht, but I won't be. We could literally tax billionaires at 100%, and their standard of living would not change in the slightest.

Pretty much because they (business owners .etc) have more resources to control what is actually personal/taxable income, turning over $200k paying yourself small dividend/salary income and writing off costs and owning expensive assets under the business rather than personally allows a better standard of living than an employee making the same amount or more to a level.You proposed we eliminate taxation for those making less than $250,000, it's only common sense then that anybody making more would need to have their taxes raised to compensate for that. You might be swayed by crocodile tears coming from people looking to buy a large yacht to tow their smaller yacht, but I won't be. We could literally tax billionaires at 100%, and their standard of living would not change in the slightest.

Increasing tax rates just punishes hardworking people left in high ranking corporate or professional jobs rather than people with high abundant wealth, not 'fair' if legal loopholes still exist.

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

Well I think it's safe to say that in this hypothetical scenario, we would also be simplifying and flattening out the tax code. Having it be longer than a Tale of Two Cities and War and Peace combined benefits exclusively the people who can hire a full battalion of tax lawyers.Increasing tax rates just punishes hardworking people left in high ranking corporate or professional jobs rather than people with high abundant wealth, not 'fair' if legal loopholes still exist.

I think you have a surface-level understanding of the financial crisis. The government, on both sides of the aisle, set up incentives for the banking system to engage in activity that is not only risky, but cannot possibly end well, all for the purposes of providing mortgages to people who were not in a position to own property. They then backed those incentives with mortgage-backed securities and collateral debt obligations, the latter of which offered interest rates higher than government bonds and were associated with zero risk. They effectively told banks to give people “free money” and if they’re unable to pay back, the bank can both repossess the property *and* cash their checks. You would be insane not to take advantage of that, so lenders did, en masse, until they overextended themselves and ran out of liquidity. The bubble was created by the government claiming that it can overcome the law of conservation of energy and magically turn one dollar into three, to put it in layman’s terms - it had to end the way it did. Deregulation’s one thing, boneheaded monetary policy is another. No amount of regulation will make someone who’s unable to pay their mortgage conjure up money to pay it with, and that’s that. The expectation was that as soon as people are housed, they will be able to increase their capability to make income. Surprise, as it turns out, people who are bad with money are bad with money whether they own the roof over their heads or not. That’s neither here nor there though.The same people that brought us the invasion of Afghanistan and Iraq 2: Electric Boogaloo without any exit strategy. At the behest of their billionaire and corporate donors, of course. They were even warned in the early 2000s that deregulation was causing instability in the housing market, and kept pushing ahead with more of it anyway. Probably in the hopes that a Dem would be elected president before the shit ultimately hit the fan.

Trumpists aside, how is it not a red flag that every president until now has divulged their returns but suddenly ronald mcdonald wont do it. Its important for presidents to divulge this for obvious fraud reasons, although they didn't find anything criminal anyway, the bigger concern about his taxes as well as why they need to be divulged is due to foreign interests/loyaties. Ever heard the phrase money is power/root of all evil/where the heart is/need I go on?

- Joined

- Dec 26, 2013

- Messages

- 17,799

- Trophies

- 3

- Location

- The Lands Between

- Website

- gbatemp.net

- XP

- 8,718

- Country

Give me a break, as if banks weren't fully aware that the predatory loans they were handing out would never be repaid. No employer looks at a resume and says, "oh hey, you live in a house instead of an apartment, here's a 500% raise!" The whole point of the scheme was that people make payments for a few months to a year, and then the bank gets to repossess the house as well. They knew they were creating a bubble, and they knew it'd pop. Thus the reason "free market" economics are doomed to failure: billionaires and corporations will only ever do the right thing after exhausting all other options, or if they're regulated into a very tight box and monitored so closely that it becomes uncomfortable for the people at the top.No amount of regulation will make someone who’s unable to pay their mortgage conjure up money to pay it with, and that’s that. The expectation was that as soon as people are housed, they will be able to increase their capability to make income.

Of course they knew - what does that change? They’re not in the business of ensuring that people have housing, they’re in the business of finance. Their core objective is to make money. If you set up perverse incentives, you will get perverse results. The government wanted to make access to housing easier, but it did so in a dumb-dumb way and the economy crashed. The incentive was to provide loans, not to ensure a favourable outcome, so why would anyone care what the outcome was? Banks don’t control economic policy (although they do lobby, of course) - the government does. Ultimately it’s the government’s fault, it (almost) always is. The banks did exactly what they’re designed to do - their only error was overextending themselves, and the banks that did that filed for bankruptcy as a result, that’s their boo-boo. The bubble was created, and popped, by Washington. If you give someone a bottomless jar of money and tell them they can take as much as they want, someone’s taking the whole jar - it’s gonna happen. Those loans would’ve never been given if the government didn’t provide asinine securities to back them up, they would’ve been too risky (with proof positive being that they were unpayable) and the bubble would’ve never formed.Give me a break, as if banks weren't fully aware that the predatory loans they were handing out would never be repaid. No employer looks at a resume and says, "oh hey, you live in a house instead of an apartment, here's a 500% raise!" The whole point of the scheme was that people make payments for a few months to a year, and then the bank gets to repossess the house as well. They knew they were creating a bubble, and they knew it'd pop. Thus the reason "free market" economics are doomed to failure: billionaires and corporations will only ever do the right thing after exhausting all other options, or if they're regulated into a very tight box and monitored so closely that it becomes uncomfortable for the people at the top.

Similar threads

- Replies

- 1

- Views

- 615

- Replies

- 9

- Views

- 1K

- Replies

- 25

- Views

- 2K

- Replies

- 455

- Views

- 22K

Site & Scene News

New Hot Discussed

-

-

30K views

New static recompiler tool N64Recomp aims to seamlessly modernize N64 games

As each year passes, retro games become harder and harder to play, as the physical media begins to fall apart and becomes more difficult and expensive to obtain. The... -

26K views

Nintendo officially confirms Switch successor console, announces Nintendo Direct for next month

While rumors had been floating about rampantly as to the future plans of Nintendo, the President of the company, Shuntaro Furukawa, made a brief statement confirming... -

24K views

TheFloW releases new PPPwn kernel exploit for PS4, works on firmware 11.00

TheFlow has done it again--a new kernel exploit has been released for PlayStation 4 consoles. This latest exploit is called PPPwn, and works on PlayStation 4 systems... -

22K views

Name the Switch successor: what should Nintendo call its new console?

Nintendo has officially announced that a successor to the beloved Switch console is on the horizon. As we eagerly anticipate what innovations this new device will... -

18K views

A prototype of the original "The Legend of Zelda" for NES has been found and preserved

Another video game prototype has been found and preserved, and this time, it's none other than the game that spawned an entire franchise beloved by many, the very...by ShadowOne333 32 -

14K views

DOOM has been ported to the retro game console in Persona 5 Royal

DOOM is well-known for being ported to basically every device with some kind of input, and that list now includes the old retro game console in Persona 5 Royal... -

12K views

AYANEO officially launches the Pocket S, its next-generation Android gaming handheld

Earlier this year, AYANEO revealed details of its next Android-based gaming handheld, the AYANEO Pocket S. However, the actual launch of the device was unknown; that... -

11K views

Delta emulator for iOS will support iPad devices in its next update

With just a couple weeks after its initial release in the App Store, the Delta emulator for iOS was received with great success, after Apple loosened up its rules in...by ShadowOne333 36 -

11K views

Mario Builder 64 is the N64's answer to Super Mario Maker

With the vast success of Super Mario Maker and its Switch sequel Super Mario Maker 2, Nintendo fans have long been calling for "Maker" titles for other iconic genres... -

11K views

Anbernic reveals the RG35XXSP, a GBA SP-inspired retro handheld

Retro handheld manufacturer Anbernic has revealed its first clamshell device: the Anbernic RG35XXSP. As the suffix indicates, this handheld's design is inspired by...

-

-

-

302 replies

Name the Switch successor: what should Nintendo call its new console?

Nintendo has officially announced that a successor to the beloved Switch console is on the horizon. As we eagerly anticipate what innovations this new device will...by Costello -

233 replies

Nintendo officially confirms Switch successor console, announces Nintendo Direct for next month

While rumors had been floating about rampantly as to the future plans of Nintendo, the President of the company, Shuntaro Furukawa, made a brief statement confirming...by Chary -

133 replies

New static recompiler tool N64Recomp aims to seamlessly modernize N64 games

As each year passes, retro games become harder and harder to play, as the physical media begins to fall apart and becomes more difficult and expensive to obtain. The...by Chary -

96 replies

Ubisoft reveals 'Assassin's Creed Shadows' which is set to launch later this year

Ubisoft has today officially revealed the next installment in the Assassin's Creed franchise: Assassin's Creed Shadows. This entry is set in late Sengoku-era Japan...by Prans -

88 replies

The Kingdom Hearts games are coming to Steam

After a little more than three years of exclusivity with the Epic Games Store, Square Enix has decided to bring their beloved Kingdom Hearts franchise to Steam. The...by Chary -

80 replies

TheFloW releases new PPPwn kernel exploit for PS4, works on firmware 11.00

TheFlow has done it again--a new kernel exploit has been released for PlayStation 4 consoles. This latest exploit is called PPPwn, and works on PlayStation 4 systems...by Chary -

78 replies

"Nintendo World Championships: NES Edition", a new NES Remix-like game, launching July 18th

After rumour got out about an upcoming NES Edition release for the famed Nintendo World Championships, Nintendo has officially unveiled the new game, titled "Nintendo...by ShadowOne333 -

71 replies

DOOM has been ported to the retro game console in Persona 5 Royal

DOOM is well-known for being ported to basically every device with some kind of input, and that list now includes the old retro game console in Persona 5 Royal...by relauby -

65 replies

Microsoft is closing down several gaming studios, including Tango Gameworks and Arkane Austin

The number of layoffs and cuts in the videogame industry sadly continue to grow, with the latest huge layoffs coming from Microsoft, due to what MIcrosoft calls a...by ShadowOne333 -

62 replies

Mario Builder 64 is the N64's answer to Super Mario Maker

With the vast success of Super Mario Maker and its Switch sequel Super Mario Maker 2, Nintendo fans have long been calling for "Maker" titles for other iconic genres...by Scarlet

-

Popular threads in this forum

General chit-chat

- No one is chatting at the moment.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

@

BakerMan:

tomorrow's memorial day, so i've been looking for a playlist, but it's all just country and alternative rock

@

BakerMan:

tomorrow's memorial day, so i've been looking for a playlist, but it's all just country and alternative rock -

-

@

BakerMan:

why the hell can't i find one with a song about the soldiers who died in battle, the very reason we celebrate

@

BakerMan:

why the hell can't i find one with a song about the soldiers who died in battle, the very reason we celebrate -

-

-

-

-

@

RedColoredStars:

Stayin inside for memorial day. Just like other holidays, most people dont care or think about the actual reasons behind it. For most it's just another reason to get shit faced drunk and spout off hyper-patriotic nonsense. The Trumpers around here going to be out in full force with their trucks and guns and flags making noise all over town. Hard pass.+1

@

RedColoredStars:

Stayin inside for memorial day. Just like other holidays, most people dont care or think about the actual reasons behind it. For most it's just another reason to get shit faced drunk and spout off hyper-patriotic nonsense. The Trumpers around here going to be out in full force with their trucks and guns and flags making noise all over town. Hard pass.+1

You arent'?

You arent'?